Theory of Everything in real estate investment

Quantum Analysis of real estate investment is the Theory of Everything that can happen to real estate investment. Including the 2000s housing bubble, the Subprime mortgage crisis, COVID-19, etc.

Difficulty: medium. 9 min read.

Table of Contents

Description

Wikipedia helps us define the Theory of Everything in real estate investing:

Theory of Everything (TOE, final theory, ultimate theory, unified investment theory or master theory) is a singular, all-encompassing, coherent theoretical framework of real estate investment analysis that fully explains and links together all investment scenarios for a certain real estate.

Quantum real estate analysis is the Theory of Everything in REI (the same as the REI TOE).

Quantum REI analysis is based on two central ideas from the TOE in Physics and the TOE in Math.

TOE in Physics

Over the past few centuries, two theoretical frameworks have been developed that, together, most closely resemble a Theory of Everything in Physics. These two theories are general relativity and quantum mechanics.

The central idea of quantum mechanics is that anything can happen in this world, and you have to compute all possible options. Quantum real estate analysis takes this approach and carefully runs through billions of investment scenarios.

Let's compare classical and quantum real estate analysis.

1) Classic real estate analysis is limited to calculating a single value for each indicator from the selected KPI set. It averages the input data and obtains a single value for each indicator. This is considered to be the most likely value and is a good representation of the future evolution of the investment. Unfortunately, this only works when we analyze real estate in an area with the identical development:

In all other cases, a single indicator value can greatly mislead and even cheat the investor. The "Prologue to Quantum Analysis of Real Estate Investment" chapter gives an example of a property on a seaside street:

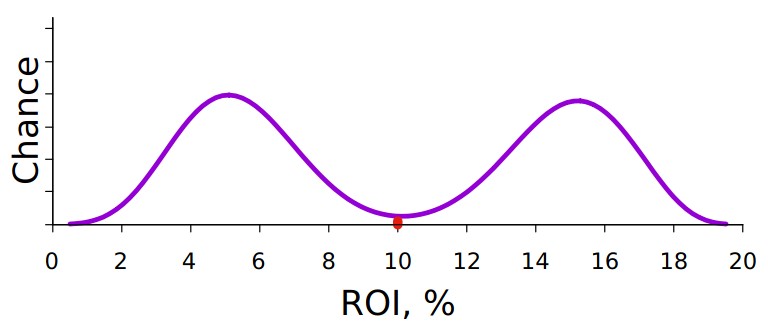

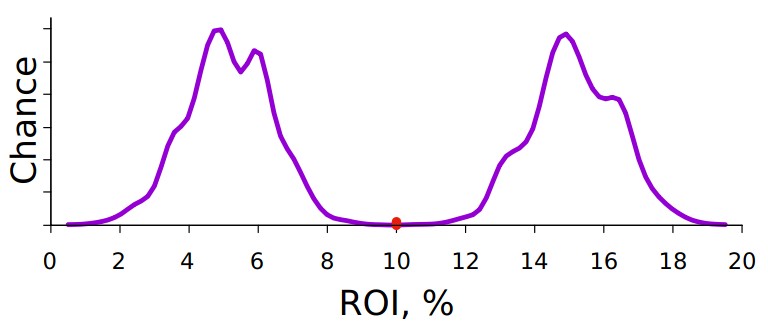

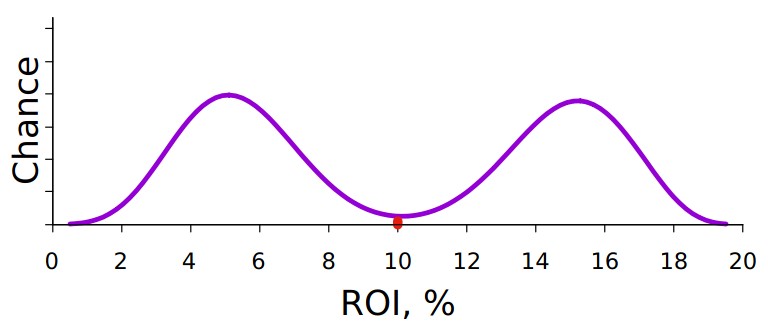

The quantum plot of ROI shows two peaks:

The peaks have the same high chances. They correspond to the first and second line houses and are far apart on the quantum plot. Classical analysis in this situation would provide an average value between the peaks. What classic real estate analysis considers the most realistic ROI value is the most incredible value in this situation. The investor-buyer has almost zero chances that the home purchased will have an ROI value near the average.

2) Quantum real estate analysis does not care about calculating the best-fit indicator value. As a TOE, Quantum Analysis looks at all possible ROI values and shows their chances on a quantum graph. Similarly, quantum real estate analysis creates quantum plots of "everything that can happen" for other indicators in the KPI set.

Even if the house is in an area with chaotic development:

, quantum REI analysis will easily show that the chaotic nature in the quantum indicator plots. They will be just as chaotic with many peaks.

TOE in Math

Okay, we have prepared billions of scenarios in which the investment can evolve. What's next? Category theory will help us make sense of this huge mountain of scenarios.

Wikipedia:

Category theory is a general theory of mathematical structures and their relations. ... Nowadays, category theory is used in almost all areas of mathematics, and in some areas of computer science.

Category theory pretends to be a Theory of Everything in Mathematics. It breaks down the object of study into categories. Category theory has little interest in the values of individual categories. It focuses on the research of mutual relations of categories.

We will discuss two approaches to the study of trees:

1) The classical approach measures some trees, averages the data. If we explore the mythical "average" tree in detail, we "can't see the forest for the trees."

Painter Georgia O'Keeffe said:

“Nothing is less real than realism. Details are confusing. It is only by elimination, by emphasis, that we get at the real meaning of things.”

2) Category theory approach splits trees into categories according to their types and explores the synergy of different categories of trees. This allows us to understand forest life as one big ecosystem and avoid exploring individual trees.

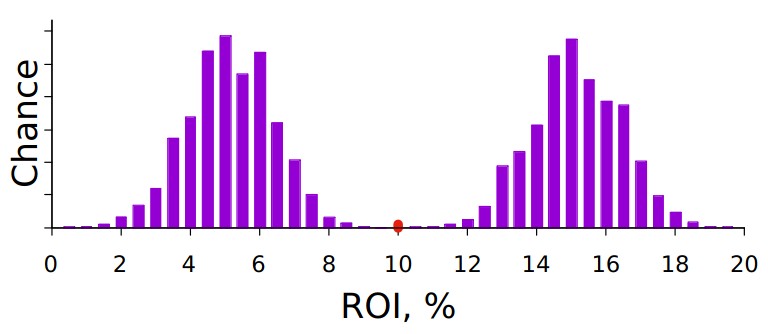

Quantum real estate analysis explores billions of investment scenarios in the manner of category theory (Approach 2). It divides all possible indicator values into categories. For example, each category can combine investment scenarios with nearly equal indicator values. The neighboring categories differ by a fixed step of the indicator value. Quantum analysis calculates the chance for each category that the indicator will be in it. This is how the indicator's raw quantum plot comes out:

Note 1. The quantum plot of the indicator clearly shows the categories by which the splitting occurred. A post-production can smooth out the quantum plot to make it easier to read:

Very strong smoothing is appropriate for educational purposes:

But the smoothed form should not be misleading. Before you create a smoothed graph, you always use the category split first.

Note 2. The quantum plot does not show the absolute values of the chances of a particular category. It should switch the investor's attention from examining the heights of individual columns to comparing their heig

Amazing potency of Quantum REI analysis

Classical REI analysis is limited to a few forecasts:

- Worst case

- Neutral case

- Best case.

Technically, there is no problem to run 10, 100 or 1,000 scenarios, even on an ordinary laptop. But the classical analysis doesn't know how to select additional scenarios and what to do with them later.

Quantum REI analysis:

- Runs billions of investment scenarios for a single investment (profound respect and esteem for TOE in Physics)

- Studies investment scenarios as a whole ensemble (profound respect and esteem for TOE in Maths.)

Bird’s-eye view

Sam Walton, founder of Wal-Mart, wrote the "Made In America" book. Wal-Mart's quick growth was driven by the use of private aviation. Sam Walton's personal 1946 Ercoupe:

Sam explored from the air the location for the new stores. From a bird's eye view, he had a perfect view of all the neighborhoods, the roads, their occupancy by cars, and their mutual location. Sam was free of the small unnecessary details that are distracting when viewing a location from the ground. The flight made choosing a location for the new store elementary.

Let the birds show you what the world looks like from the air:

A bird's-eye view of the billions of scenarios reveals surprising new scenarios in which investment can evolve.

FAQ

Quora.com publishes many questions on the Theory of Everything. I answered some questions relating REI TOE.

Q1: If REI TOE is eventually developed, would this mean the end of property analysis?

That is definitely not!

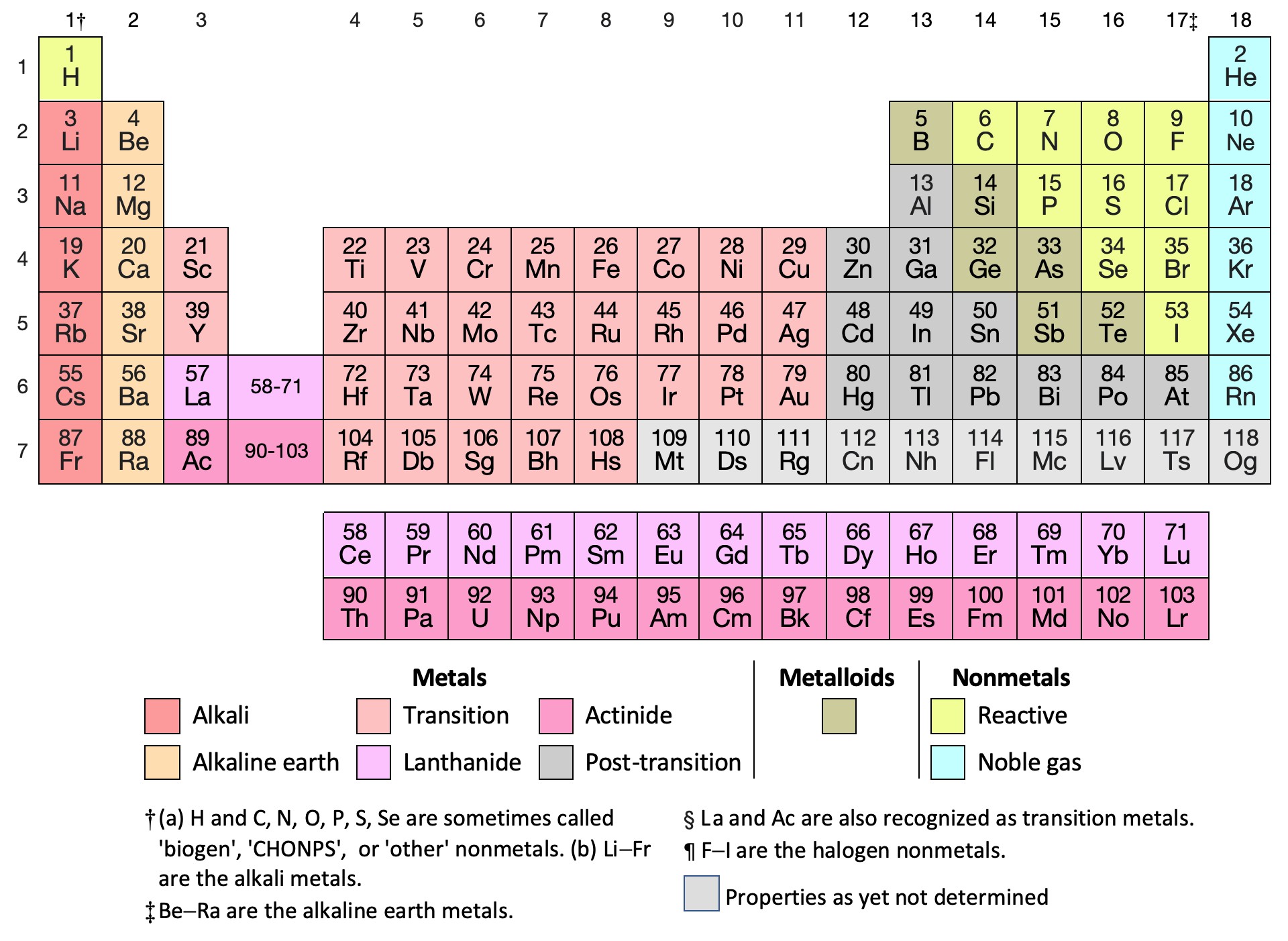

Periodic Table was a bird's-eye view of the famous Elements:

The Periodic Table didn't kill the progress of chemistry. On the contrary, it accelerated it. The missing elements in the table indicated where to look for new chemical elements.

REI Theory of Everything is a bird's eye view of the future of an investment. Quantum plots show the investor all scenarios of investment evolution. (The great majority of them go undetected in a classical real estate analysis.) But quantum plots aren't the only way to show billions of investment scenarios. Quantum analysis of real estate investment has to learn how to operate with billions of scenarios.

Q2: Does REI TOE really explain everything of this world?

Potentially, the REI TOE can explain any scenarios in which an investment might evolve. That's why it's called the "Theory of Everything." But in practice the REI TOE has two limitations.

1) Before applying the REI TOE selects one of the KPI sets, e.g. Income capitalization or Discounted cash flow. The REI TOE explains all possible scenarios of the investor's real estate development. But it does so only within the indicators of the selected KPI set.

2) The REI TOE uses statistics for the past few decades and bases investment scenarios only on the events of those years.

- The REI TOE is not a historical researcher. It doesn't suggest the possibility of World War III, because at the time of World War II, statistics have not yet collected data on real estate

- The REI TOE is not a science fiction writer. It will not run scenarios for a Martian invasion that have not yet occurred:

Q3: Why is the 'Theory of Everything' so important in real estate investment?

Real estate analysis needs a unifying that brings investment analysts together. Quantum real estate analysis in the role of TOE allows different analysts to analyze investment real estate in the same manner. They will be able to agree on the pros and cons of a property.

Q4: What is the simplest theory for the REI TEO?

The simplest REI Theory of Everything is classical real estate analysis with its three typical forecasts:

- Worst case

- Neutral case

- Best case.

Classical real estate analysis is popular as the simplest REI TOE among analysts and investors because it is not difficult to develop and understand.

Q5: Is REI TOE a science or a plaything? Which one is it close to?

The answer depends on which REI Theory of Everything, we are talking about.

Quantum real estate analysis as the REI TOE is definitely a science because it has reproducibility. Different quantum analysts prepare the same quantum indicator plots for the same real estate.

Classical (traditional) REI analysis, as the simplest REI TOE, is nearer to a toy. It randomly chooses one investment scenario out of billions and declares it the most correct forecast. This leads to the situation: "Where there are two RE investors, there are at least three investment analyses."

See more about the science aspect under the "Quantum Scenario Modeling of REI" chapter.